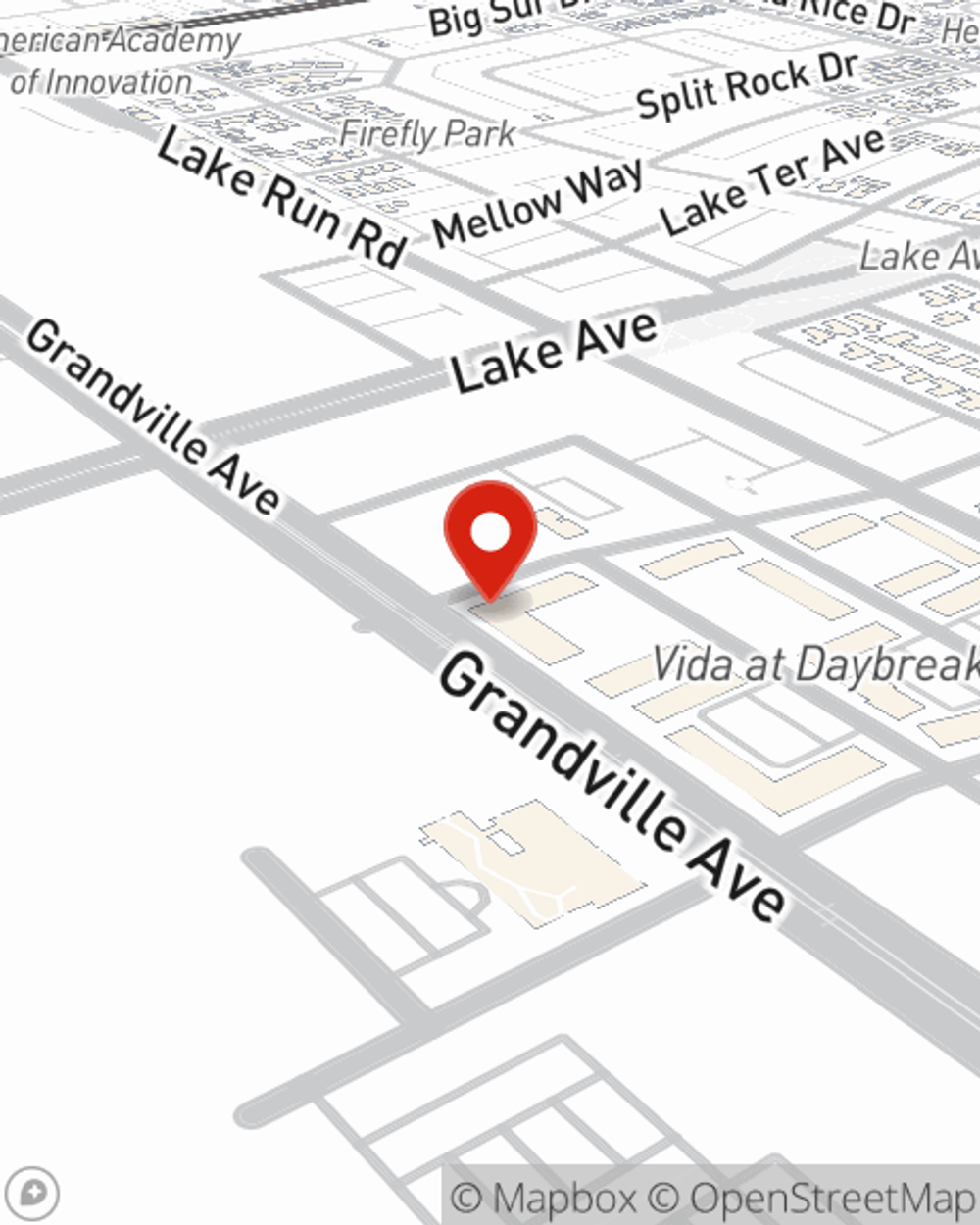

Renters Insurance in and around South Jordan

Get renters insurance in South Jordan

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Think about all the stuff you own, from your TV to dresser to lamp to towels. It adds up! These possessions could need protection too. For renters insurance with State Farm, you've come to the right place.

Get renters insurance in South Jordan

Your belongings say p-lease and thank you to renters insurance

Renters Insurance You Can Count On

When renting makes the most sense for you, State Farm can help insure what you do own. State Farm agent Paul Arguello can help you develop a policy for when the unpredictable, like an accident or a fire, affects your personal belongings.

There's no better time than the present! Reach out to Paul Arguello's office today to help make life go right in your rented home.

Have More Questions About Renters Insurance?

Call Paul at (801) 531-6700 or visit our FAQ page.

Simple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Paul Arguello

State Farm® Insurance AgentSimple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.